· Risks and opportunities

- Materiality

Key observations:

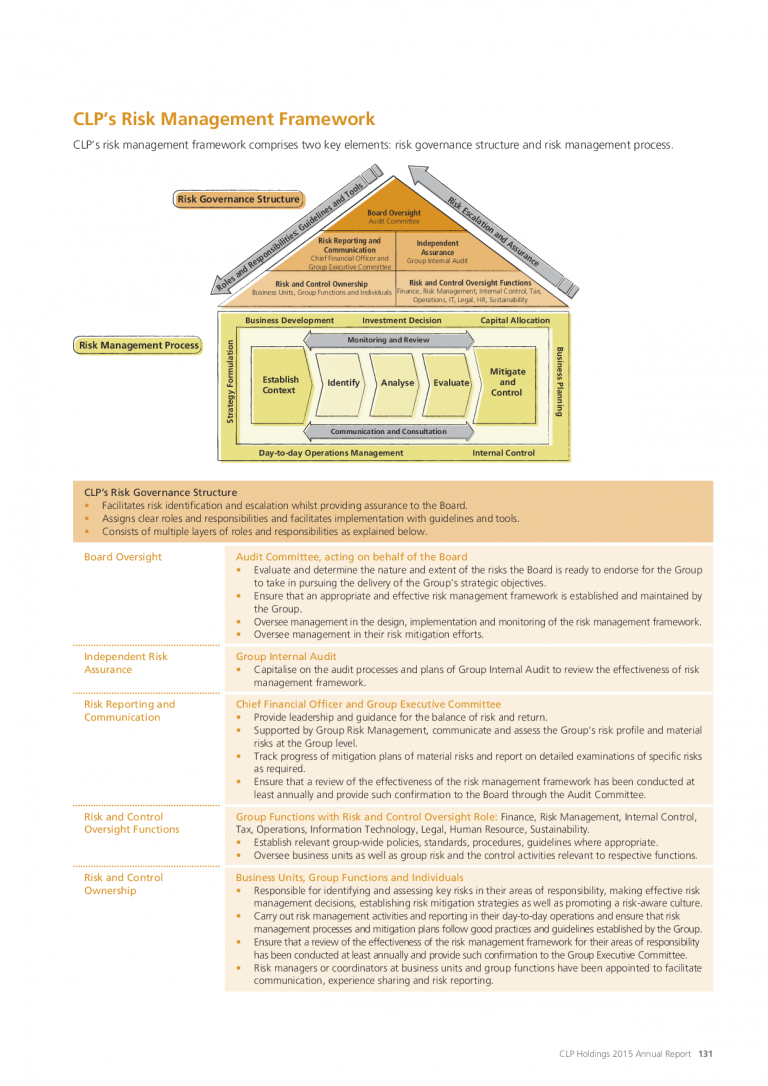

CLP’s risk section provides detailed information about its risk management processes. Specifically, this includes the company’s risk management philosophy, risk appetite and risk profiling criteria. On page 131 there is a diagram showing both the risk governance structure and the risk management process which helps to clearly lay out CLP’s risk framework. Pages 134-137 categorise CLP’s material risks into four main areas and for each principal risk, highlights whether there has been a change in the level of risk in 2015 and what CLP has done to mitigate these risks.

Areas where there could be closer alignment to the International <IR> Framework requirements on risk include disclosing how the key risks relate to CLP’s effects on, and the continued availability, quality and affordability of relevant capitals, and the likelihood that each risk will come to fruition and the magnitude of its effect if it does.

A next step might be to identify and explain the key opportunities that affect CLP’s ability to create value in the short, medium and long term.