· Risks and opportunities

- The capitals

- Value creation

- Conciseness

- Connectivity of information

- Materiality

- Stakeholder relationships

Key observations:

Sasol outlines the company’s investment criteria, connecting the strategic decisions made in allocating resources to run Sasol’s business and advance the company’s growth projects based on integrated criteria (the six capitals).

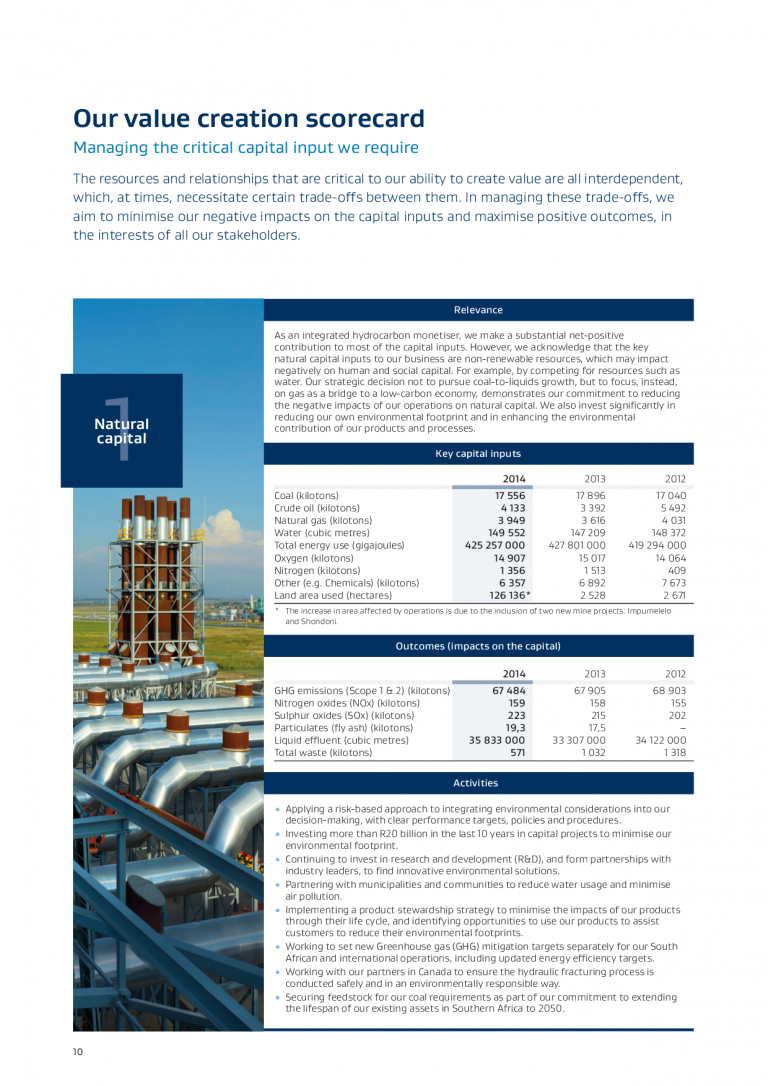

Sasol provides an overview of each capital, which describes how each enables the company to operate sustainably and grow. The report provides signposting to the ‘value creation scorecard’, which addresses each of these capitals in more detail. Specifically, for each capital, the relevance of the capital is discussed, key inputs are identified, and outcomes (described as the impacts on the capital) are highlighted. The key activities related to each capital are also outlined. All in all, this provides the reader with an understanding of the importance of the capitals and how these stocks of value are increased, decreased or transformed through the activities of the business.

Sasol also limits repetition through the use of internal references to further detail in other parts of the Integrated Report and other reports. This commitment to conciseness also strengthens the connectivity of information displayed throughout the report and allows readers to obtain additional detail and understand how the full suite of corporate reports work together.